获取优惠价格

Tel:18790282122HST圆锥破碎机产量800TH

圆锥破圆锥破碎机设备单杠液压圆锥破碎机世邦 ...

hst圆锥破配备的全自动控制系统提供手动控制、恒定排料口控制、恒功率控制等多种运转模式供用户选择;可连续监测破碎机内部实际负荷,从而优化破碎机的利用率,使破碎机在 圆锥破圆锥破碎机设备单杠液压圆锥破碎机世邦 ...hst圆锥破配备的全自动控制系统提供手动控制、恒定排料口控制、恒功率控制等多种运转模式供用户选择;可连续监测破碎机内部实际负荷,从而优化破碎机的利用率,使破碎机在

查看更多

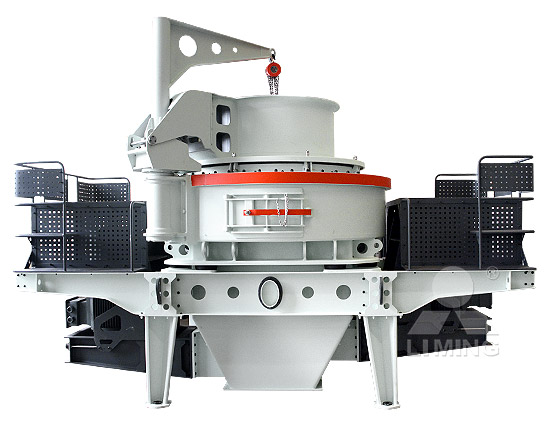

HST单缸液压圆锥破碎机-单杠破碎机-破碎设备-黎明重工

产量:205-790t/h 最大进料粒度:≤300mm 出料粒度:≥35mm/div>. 设备咨询. 索取报价. 实拍图片. HST单缸液压 圆锥破 集机械、液压、电气、自动化、智能控制等技术于一体, HST单缸液压圆锥破碎机-单杠破碎机-破碎设备-黎明重工产量:205-790t/h 最大进料粒度:≤300mm 出料粒度:≥35mm/div>. 设备咨询. 索取报价. 实拍图片. HST单缸液压 圆锥破 集机械、液压、电气、自动化、智能控制等技术于一体,

查看更多

HST单缸液压圆锥破碎机_制砂机冲击式制砂机VSI制砂 ...

hst单缸液压圆锥破碎机是我公司吸收美国、德国等先进破碎机技术,并结合二十多年的制造经验,研发改进的新型破碎设备。该圆锥破碎机集液压润滑、过载保护、维护清仓、plc HST单缸液压圆锥破碎机_制砂机冲击式制砂机VSI制砂 ...hst单缸液压圆锥破碎机是我公司吸收美国、德国等先进破碎机技术,并结合二十多年的制造经验,研发改进的新型破碎设备。该圆锥破碎机集液压润滑、过载保护、维护清仓、plc

查看更多

世邦矿山破碎HST单缸液压圆锥破碎机 世邦工业科技 ...

展品介绍. HST单缸液压圆锥破碎机是世邦集团总结多年经验,广泛吸收美国、德国等先进破碎机技术,而自主研发和设计的新型高效破碎机。 该圆锥破碎机集机械、液压、电气、 世邦矿山破碎HST单缸液压圆锥破碎机 世邦工业科技 ...展品介绍. HST单缸液压圆锥破碎机是世邦集团总结多年经验,广泛吸收美国、德国等先进破碎机技术,而自主研发和设计的新型高效破碎机。 该圆锥破碎机集机械、液压、电气、

查看更多

HST单缸液压圆锥破碎机

HST单缸液压圆锥破碎机. 应用领域:砂石料场、矿山开采、煤矿开采、混凝土搅拌站、干粉砂浆、电厂脱硫、石英砂等. 生产能力. 40-2000t/h. 进料粒度. ≤560㎜. 电机功率. 90 HST单缸液压圆锥破碎机HST单缸液压圆锥破碎机. 应用领域:砂石料场、矿山开采、煤矿开采、混凝土搅拌站、干粉砂浆、电厂脱硫、石英砂等. 生产能力. 40-2000t/h. 进料粒度. ≤560㎜. 电机功率. 90

查看更多

HST单缸液压圆锥破碎机-效率高-自动化-多腔型-精度高

HST单缸液压圆锥破碎机进料粒度为0-370mm,生产能力为45-2130吨/时,适用于花岗岩、辉绿岩、玄武岩、河卵石、石灰石、白云石、金属矿和非金属矿石等物料。 HST单缸液压圆锥破碎机-效率高-自动化-多腔型-精度高HST单缸液压圆锥破碎机进料粒度为0-370mm,生产能力为45-2130吨/时,适用于花岗岩、辉绿岩、玄武岩、河卵石、石灰石、白云石、金属矿和非金属矿石等物料。

查看更多

HST单缸液压圆锥破碎机技术优势和使用案例-河南黎明 ...

2020年3月25日 HST单缸液压圆锥破是集机械、液压、电气、自动化、智能控制等技术于一体的破碎机,目前主要被应用于金属与非金属矿、水泥、砂石、冶金等行业的中碎、细碎 HST单缸液压圆锥破碎机技术优势和使用案例-河南黎明 ...2020年3月25日 HST单缸液压圆锥破是集机械、液压、电气、自动化、智能控制等技术于一体的破碎机,目前主要被应用于金属与非金属矿、水泥、砂石、冶金等行业的中碎、细碎

查看更多

HST单缸液压圆锥破碎机石灰石细碎机选矿生产线 ...

该系列石灰石细碎机通过将破碎腔型、偏心距与运动参数相匹配,实现了更高的生产效率,更优的产品质量;hst系列单缸液压圆锥破碎机配备全自动控制系统,实现手动控制、恒定 HST单缸液压圆锥破碎机石灰石细碎机选矿生产线 ...该系列石灰石细碎机通过将破碎腔型、偏心距与运动参数相匹配,实现了更高的生产效率,更优的产品质量;hst系列单缸液压圆锥破碎机配备全自动控制系统,实现手动控制、恒定

查看更多

破碎生产线上的二级破碎专家 HPT/HST系列圆锥破家族 ...

2016年11月23日 HPT液压圆锥破碎机是引进德国技术,并结合中国金属材料性能而设计的一款高性能破碎机,主要用于金属矿山、建筑砂石加工中的二段破碎和三段破碎环节,因 破碎生产线上的二级破碎专家 HPT/HST系列圆锥破家族 ...2016年11月23日 HPT液压圆锥破碎机是引进德国技术,并结合中国金属材料性能而设计的一款高性能破碎机,主要用于金属矿山、建筑砂石加工中的二段破碎和三段破碎环节,因

查看更多

HST圆锥破碎机产量1900T H

HST圆锥破碎机产量1900T H 2021-03-09T11:03:51+00:00 Who we are > Products > Cases > Solutions > Contact Us > Solutions. Copper ore beneficiation plant; Iron Ore Beneficiation Plant; Iron ore powder beneficiation production sand HST圆锥破碎机产量1900T HHST圆锥破碎机产量1900T H 2021-03-09T11:03:51+00:00 Who we are > Products > Cases > Solutions > Contact Us > Solutions. Copper ore beneficiation plant; Iron Ore Beneficiation Plant; Iron ore powder beneficiation production sand

查看更多

HST Calculator / Harmonized Sales Tax Calculator

History of HST implementation in Canada. In 1997 Harmonized Sales Tax (HST) was introduced in three provinces – New Brunswick, Newfoundland and Labrador, and Nova Scotia. In 2010 HST was implemented in HST Calculator / Harmonized Sales Tax CalculatorHistory of HST implementation in Canada. In 1997 Harmonized Sales Tax (HST) was introduced in three provinces – New Brunswick, Newfoundland and Labrador, and Nova Scotia. In 2010 HST was implemented in

查看更多

About us - HST

HST Provides Professional Services to Clients Across Various Industries. HST works with clients to solve business growth, operational, people, financial, tax, governance, risk, learning and compliance challenges with locally relevant solutions. We do not provide ‘off the shelf’ and standard solutions developed for other markets. About us - HSTHST Provides Professional Services to Clients Across Various Industries. HST works with clients to solve business growth, operational, people, financial, tax, governance, risk, learning and compliance challenges with locally relevant solutions. We do not provide ‘off the shelf’ and standard solutions developed for other markets.

查看更多

GST/HST Information for Canadian Businesses - LiveAbout

Updated on 05/12/18. The Federal GST (Goods and Services Tax), a 5 percent tax on most Canadian goods and services, began on January 1, 1991, replacing the hidden 13.5% Manufacturer's Sales Tax. It was supposed to improve and streamline the tax system, particularly for export businesses. Unfortunately not all provinces signed on to merge their ... GST/HST Information for Canadian Businesses - LiveAboutUpdated on 05/12/18. The Federal GST (Goods and Services Tax), a 5 percent tax on most Canadian goods and services, began on January 1, 1991, replacing the hidden 13.5% Manufacturer's Sales Tax. It was supposed to improve and streamline the tax system, particularly for export businesses. Unfortunately not all provinces signed on to merge their ...

查看更多

Instructions for completing a GST/HST Return - Canada.ca

2017年1月1日 Enter the GST/HST amount of your refund or your amount due (lines 113C, 114, and 115) Complete Schedule A, Builders – transitional information. Complete Schedule B, Calculation of recaptured input tax credits (RITCs) Complete Schedule C, Reconciliation of RITCs. Video: How to complete a GST/HST return. Instructions for completing a GST/HST Return - Canada.ca2017年1月1日 Enter the GST/HST amount of your refund or your amount due (lines 113C, 114, and 115) Complete Schedule A, Builders – transitional information. Complete Schedule B, Calculation of recaptured input tax credits (RITCs) Complete Schedule C, Reconciliation of RITCs. Video: How to complete a GST/HST return.

查看更多

Harmonized Sales Tax (HST): Definition as Canadian Sales Tax

2023年10月5日 Harmonized Sales Tax (HST): The Harmonized Sales Tax (HST) is a combination of the Canadian Goods and Services Tax (GST) and Provincial Sales Tax (PST) that is applied to taxable goods and ... Harmonized Sales Tax (HST): Definition as Canadian Sales Tax2023年10月5日 Harmonized Sales Tax (HST): The Harmonized Sales Tax (HST) is a combination of the Canadian Goods and Services Tax (GST) and Provincial Sales Tax (PST) that is applied to taxable goods and ...

查看更多

File the return – Complete and file a GST/HST return - Canada.ca

Paper filing. To file a paper return, you can either mail your GST/HST return (GST34-2) to the address on your return, or file in person at a participating financial institution. Only charities and selected listed financial institutions are not required to file online. You cannot file in person at a participating financial institution if: File the return – Complete and file a GST/HST return - Canada.caPaper filing. To file a paper return, you can either mail your GST/HST return (GST34-2) to the address on your return, or file in person at a participating financial institution. Only charities and selected listed financial institutions are not required to file online. You cannot file in person at a participating financial institution if:

查看更多

那些来加拿大必须要知道的事儿(1)—— 关于HST/GST ...

什么叫HST/GST?. HST或者也叫(GST)的意思是Harmonized Sales Tax (Goods and Services Tax),翻译过来就是销售协调税(商品和服务税)。. 消费税本质是一种间接税,即企业在将产品或服务售出时,代表联邦政府收税,而最终付税的是购买产品或服务的消费者。. 而联邦 ... 那些来加拿大必须要知道的事儿(1)—— 关于HST/GST ...什么叫HST/GST?. HST或者也叫(GST)的意思是Harmonized Sales Tax (Goods and Services Tax),翻译过来就是销售协调税(商品和服务税)。. 消费税本质是一种间接税,即企业在将产品或服务售出时,代表联邦政府收税,而最终付税的是购买产品或服务的消费者。. 而联邦 ...

查看更多

HST Addis Ababa - Facebook

HST, Addis Ababa, Ethiopia. 491 likes 1 talking about this 1 was here. HST provides professional services to clients across various industries. HST Addis Ababa - FacebookHST, Addis Ababa, Ethiopia. 491 likes 1 talking about this 1 was here. HST provides professional services to clients across various industries.

查看更多

HST Stock Price Quote Morningstar

2 天之前 See the latest Host Hotels Resorts Inc stock price (HST:XNAS), related news, valuation, dividends and more to help you make your investing decisions. HST Stock Price Quote Morningstar2 天之前 See the latest Host Hotels Resorts Inc stock price (HST:XNAS), related news, valuation, dividends and more to help you make your investing decisions.

查看更多

GST/HST Statistics Tables (2013 to 2019 calendar years)

The Canada Revenue Agency’s (CRA’s) goods and services tax/harmonized sales tax (GST/HST) statistics tables provide detailed statistics relating to the GST/HST for seven calendar years from 2013 to 2019 as of December 2021. The statistics tables include only the GST/HST administered by the CRA and Revenue Québec. GST/HST Statistics Tables (2013 to 2019 calendar years)The Canada Revenue Agency’s (CRA’s) goods and services tax/harmonized sales tax (GST/HST) statistics tables provide detailed statistics relating to the GST/HST for seven calendar years from 2013 to 2019 as of December 2021. The statistics tables include only the GST/HST administered by the CRA and Revenue Québec.

查看更多

Sales Tax in Canada 2024: Guide to GST, HST, PST and QST Sales

2023年11月15日 Ontario is one of the four provinces that levies a combined federal and provincial sales tax (aka Harmonized Sales Tax). The others are Prince Edward Island, Nova Scotia, New Brunswick, and Newfoundland and Labrador. The HST in Ontario is 13%, of which 5% is the federal GST, and 8% is the provincial retail sales tax. Sales Tax in Canada 2024: Guide to GST, HST, PST and QST Sales 2023年11月15日 Ontario is one of the four provinces that levies a combined federal and provincial sales tax (aka Harmonized Sales Tax). The others are Prince Edward Island, Nova Scotia, New Brunswick, and Newfoundland and Labrador. The HST in Ontario is 13%, of which 5% is the federal GST, and 8% is the provincial retail sales tax.

查看更多

RAW 800th Episode, DX Tag-Match On RAW, Batista/Jericho - Wrestling Inc.

By Matt Boone / Oct. 19, 2008 1:08 pm EST. –The WWE RAW event that takes place in Tampa, Florida on November 3rd is being advertised as a three-hour show to celebrate the 800th episode in the ... RAW 800th Episode, DX Tag-Match On RAW, Batista/Jericho - Wrestling Inc.By Matt Boone / Oct. 19, 2008 1:08 pm EST. –The WWE RAW event that takes place in Tampa, Florida on November 3rd is being advertised as a three-hour show to celebrate the 800th episode in the ...

查看更多

HST - Home - Facebook

Uw partner voor : Verkoop, Verhuur en Service Bouw- Wegenbouwmachines Industrieweg 43, 3980 Tessenderlo, Belgium HST - Home - FacebookUw partner voor : Verkoop, Verhuur en Service Bouw- Wegenbouwmachines Industrieweg 43, 3980 Tessenderlo, Belgium

查看更多

Open or manage an account – Register - Canada.ca

Generally, you will need to register for your business number (BN) before you can register for a GST/HST account. You may register for a BN by using the online service at Business Registration Online (BRO). This is the quickest way to register for a BN. Once you have obtained your BN, you can then continue in the same session to register for a ... Open or manage an account – Register - Canada.caGenerally, you will need to register for your business number (BN) before you can register for a GST/HST account. You may register for a BN by using the online service at Business Registration Online (BRO). This is the quickest way to register for a BN. Once you have obtained your BN, you can then continue in the same session to register for a ...

查看更多

When to file – Complete and file a GST/HST return - Canada.ca

Filing deadline: June 15. Payment deadline: April 30. Different rules apply to most listed financial institutions that file annual returns and to all selected listed financial institutions. For more information about payment deadlines for annual filers, When to file – Complete and file a GST/HST return - Canada.caFiling deadline: June 15. Payment deadline: April 30. Different rules apply to most listed financial institutions that file annual returns and to all selected listed financial institutions. For more information about payment deadlines for annual filers,

查看更多

NBC News - Magna Carta: Everything You Need to Know About

2015年6月14日 LONDON — Britain is this month celebrating the 800th anniversary of Magna Carta, a document more than three times as old as the United States that established many principles of Western democracy. NBC News - Magna Carta: Everything You Need to Know About 2015年6月14日 LONDON — Britain is this month celebrating the 800th anniversary of Magna Carta, a document more than three times as old as the United States that established many principles of Western democracy.

查看更多

How to Calculate HST for Small Businesses - FreshBooks

2023年3月24日 To calculate sales tax backward, follow this formula. The price before HST is equal to the total price with tax minus the retail sales tax. The sales tax rate equals the sales tax percentage divided by 100. Take the total price with tax How to Calculate HST for Small Businesses - FreshBooks2023年3月24日 To calculate sales tax backward, follow this formula. The price before HST is equal to the total price with tax minus the retail sales tax. The sales tax rate equals the sales tax percentage divided by 100. Take the total price with tax

查看更多- vsi高效立轴冲击式破碎机

- 欧版破碎机器产量850t h

- 矿粉立磨投料试车方案

- 2pgc狼牙破碎机样本

- 黎明重工移动破碎机250

- 宜昌二手碎石机

- 河南巩义破碎机械厂磨粉机设备

- 复试塑料破碎机

- 矿粉立磨的配套

- 每小时产850T立式磨粉机械

- 磷矿石反击式矿石破碎机

- 环锤式破碎机HCSC6

- 95型雷蒙磨

- 破碎机 外企

- 碳黑立式磨粉机械

- 1小时1000方冲击破制砂机哪种好

- 石料破碎机一般大概多少钱

- 保温材料立式磨粉机

- 移动齿辊破碎机

- 时产180吨粗粉磨粉机

- 金刚砂欧版岩石破碎机

- 破碎机好卖吗

- 烟煤反击式石子破碎机

- 硅石加工防尘方法

- 1214反击破衬板规格数量

- 北京 破碎机厂家蛭石加工设备

- 每小时产2000T欧版粉石子机

- 每小时产200T圆锥式破碎机

- 金属反击式石子破碎机

- 浅析河南珍珠岩制砂生产线的三大优势